This article is a guide for affiliate marketers outside USA. There are lots of smart affiliate marketers who make money online by referring sales to hosting companies like BlueHost, HostGator, DreamHost and many other popular hosting companies. They earn money by referring sales to these companies and the earned money is kept in the respective affiliate account of each hosting company. Most of these hosting companies are located in USA and they are subject to US Tax laws. An affiliate marketer who earns commission for a sale is also subject to US tax laws. Since the parent company who provides commission for a sale is incorporated in US, the earned commission is also an income earned in USA. If the affiliate marketer is a US citizen or an immigrant, he/she is subject to US tax laws and should pay income tax for the earnings. Such people (US citizen or permanent resident) should file the tax form W-9 with the respective hosting company.

If an affiliate marketer is not a US citizen, he/she has to file tax form W-8BEN with the respective hosting company.

What is W-8BEN ?

I will summarize the whole thing! Non US persons (individuals or corporations) are liable to pay income tax at 30% (flat rate) on certain types of income earned from US sources. This tax amount is collected at the source by the payer of the income. (In the case of affiliate marketing, this tax amount is collected by hosting companies like Bluehost, Hostgator etc who pay the affiliate commission). The source (payer) which collects the tax amount is also known as “withholding agent”. Withholding agent then pays the collected tax amount to IRS (US Internal Revenue Service).

Withholding agent is responsible to collect tax and pay it to IRS. In case the agent fails to collect tax, IRS will charge the amount from the agent. The 30% withholding tax is applicable to non US persons only. Payer doesn’t need to withhold any tax from US persons. Each foreign person has to submit a W-8 (one particular version of the W-8 form) tax form with the payer (withholding agent). You may note that W-8 has to be submitted with the payer (or withholding agent) and not with the IRS. When the payer has the form W-8 on file with the accounts, they will know the payee is a non US person and they have to withhold 30% of the payment. On the other hand, if the payee is a US person, they will have a W-9 form on accounts. The payer don’t need to withhold 30% from accounts with a W-9 on file as they are US citizens.

Note 1:- In some cases, an income tax treaty negotiated with US and another country can be used to reduce this tax rate of 30%. It depends on which country you are residing and the possibility of tax treaty with the country. You can check this in official IRS website.

Note 2:- You may check this blog for further reference on the subject of W-8BEN

How to Fill Out the W-8BEN Form ?

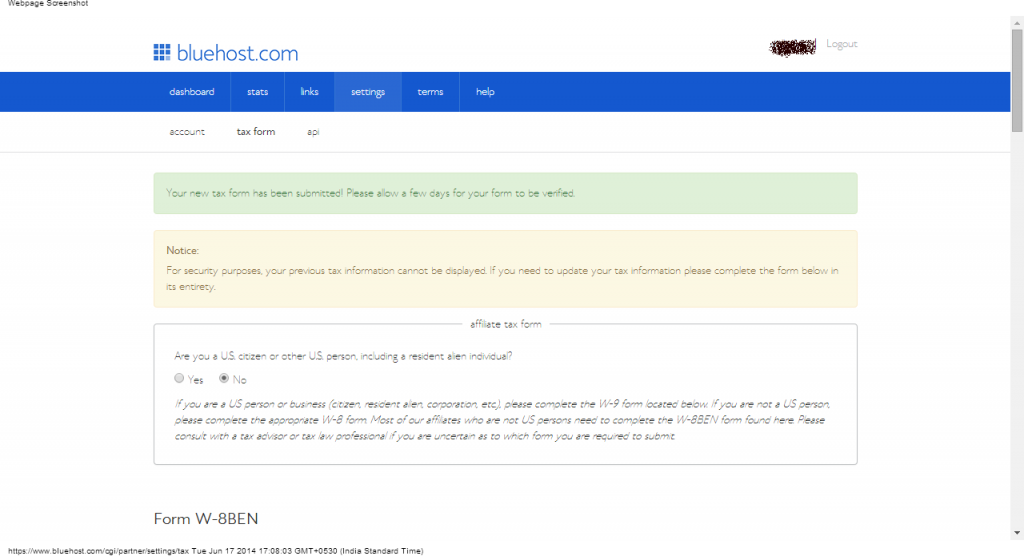

For a case study, I am using the W-8BEN form provided by Bluehost for its affiliate accounts. So here is how to fill the W-8 BEN form on BlueHost. The form is same for other companies like Hostgator, DreamHost or others, there are differences only in the way the form is presented (look and feel of form).

What to Fill ?

As shown in the screenshot, your name, your country name, your permanent address, your state/city, your country name in full are the primary fields to fill. If the present address is different from permanent address, fill those optional fields. Now comes the very important fields – SSN or EIN. SSN is Social Security Number issues for US citizens and residents only. A non US citizen don’t have an SSN or EIN. So you can leave those fields blank.

Note:- At the time I submitted the BlueHost tax form, there was a technical glitch with their system. The form was not getting accepted when I submitted with blank fields for SSN and EIN. I contacted customer support of BlueHost and they responded with a suggestion of submitting the form with any random 9 digit number. This is the reason you see a random 9 digit number on the screenshot. This is needed only for BlueHost. For other companies like Hostgator and DreamHost, you can leave those fields blank. If you face any difficulties, contact their customer support.

Finally there are some check boxes to tick. Read them carefully and select applicable ones. You may refer the screenshot to see what I have selected. In the signature field, just type your full name as signature. You can write “Owner” in the field “Capacity in which acting“.

Now hit “Submit Tax Form” and you are done. You will receive a success message screen as shown below (for BlueHost).

I hope you have got it done perfectly. If you have any doubts, drop in a comment.

I put in 9 and it still said “enter a valid EIN” so not sure what to do. Tried a few other digits too

I also had that problem. Its a glitch with bluehost system. You may just email customer support for Affiliate section. I did and got it fixed.